How to improve the way you pitch angel investors

While I’m invested in several start-ups, our group is looking for new investment opportunities so I’m being approached by lots of entrepreneurs and startups, usually online. I also joined several investors events in the northern hemisphere and was surprised to find out how many good ideas and good products fail in the presentation, pitch or way they approach investors. In this article I want to help entrepreneurs and startup in ideas how to increase their chance of getting investors engaged with their pitch.

How to pitch investors

- Get prepared for a long game.

If you think that an investor are attending events / meetings with $100,000 in their pockets, just waiting to be handed over to you, then you are completely wrong. For example, I attended the HSE event in St Petersburg which was surprisingly good, with many good ideas and many good products and techs. I was very interested in one startup, I went to ask the guys a question during networking time, and they said something like “we are looking for an investor” (yes I got that) and once the money didn’t jump out of my pocket, they didn’t show interest to answer my questions. - Do you research before you approach investors

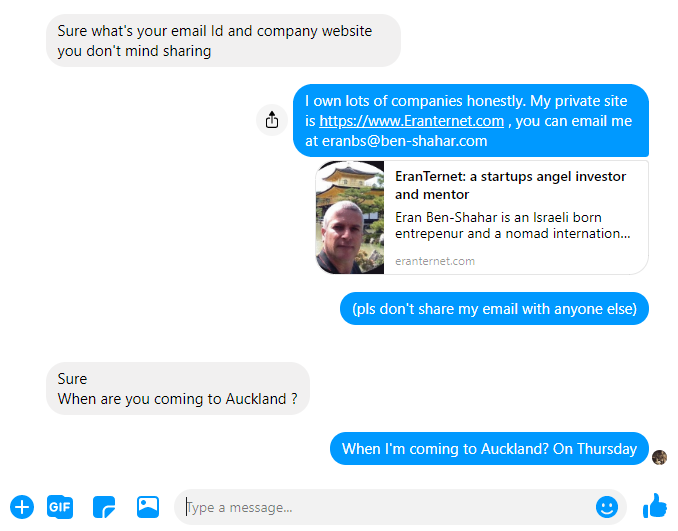

Just yesterday a New Zealander wrote me and send me some details of his venture, I asked for the pitch deck or a URL and as a reply I got this:

Issue is, that if someone does not know my website address, which is all over Google, my LinkedIn profile and my Facebook profile wallpaper – it means that they even didn’t bother to click my name on the messenger or put it in Google to see who they are speaking with. If someone is not doing their homework and research when approaching investors, then most likely that they didn’t do their research about their product, idea, intellectual property etc. You need to be serious to win the startup game. Investors are watching every minor sign to make sure that their money is invested in the right hands. That person also thinking that I’m going to Auckland just to wait him, which obviously, I’m not spending my time in meeting people which didn’t pitch me well.

- ASK before you send information.

I’m on a flight, or in a hangout meeting, or in a holiday, and then I get this LOOOOOONG text with links and thumbnails which disturbs my work, and from someone which I don’t really know: a Startupist which saw a post of mine on Facebook or got my details from a friend. I’m not even reading it, I know that this person is not sensitive to others and does not understand the electronic media. If you want to cold pitch investors, the first text needs to be short, to the point, and respecting others’ time, something like:Hello Eran, my name is John, I saw your post on Facebook, can interest you with a startups that built a beehive hotel?Or:

Hello Eran, I got your details from John, he said you may be interested in my project of beehive hotel?

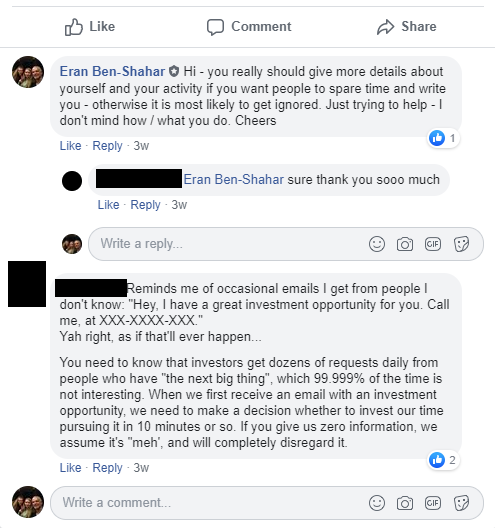

- On public groups – give AS MUCH as information as you can

On the contrary to cold messages, in public groups (like Facebook groups, online website, LinkedIn) – give as much as information as you could and not just a buzz and a request to contact you. People read content but their time is precious, if you think that a post like “I’m looking for an investor in my startup, please contact me” will work for you – think twice. He is some input from an investor in the Web/App Startup Entrepreneurs and Investors group on Facebook:

- An elevator pitch is great, but it is just the beginning

On HSE again, a startup which highly interested me – a brilliant product, a brilliant team, I seriously wanted to invest. I approached the team during the event and after I got impressed from their plan, I asked – what is the equity they would give for the $200,000 they look to raise. I got this answer:“10%”… looking at my face “no 5%, maybe 3%, we have really high value now” … and some marketing bullshit.I was really let down by this answer – if you got a business plan, be strict with it and know how to defend it. In such a case, I didn’t even wanted to ask anything else, because it was obvious for me that the guys are looking for an easy go.

- Be realistic

Another startup which I was actually involved with, and then stepped back, had a market and a product but the main founder started to be unrealistic with his valuation claims. The SaaS startup “grew” in 3 months from an MVP to a valuation of 3 billions dollars. It means that for the $200,000 investment that he was seeking at the time, investors would get a small fraction of equity, while the company didn’t really have any sales. No wonder that all investors, including me, went off.

A low valuation is also bad. A startup that was patent pending in the food market had a really good invention, and a really good market, but they estimated their value at $200,000. Low valuation for real value that you got – is a sign for problems. - Don’t use over descriptive / over impressing words

When I get pitches or messages which include self appraisals, in the shape of “most amazing”, “take 90% of the market”, “the next Facebook” , “Bill gates wants to buy us”, “We will overcome UBER”, I don’t even continue to read the pitch deck and reply that I’m too busy. Don’t self appraise your work or startup – investors are not stupid – stick to facts and facts only. Investors are not end clients that you sell them bullshit – investors are business man which did something in their life - What is really important for startup investors?

The most important factors for investors, when we look at you, is not your ideas – but (as I stated on my website):People (your team): who is going to run the show, are they capable of managing my money wellIntellectual property: do you own anything but an idea? a product / patent / clients.

Monetization: how are we going to earn our money back?

I hope I helped 🙂 will be glad to get any other idea from you

Eran